Homeowners Insurance in and around St Francisville

If walls could talk, St Francisville, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

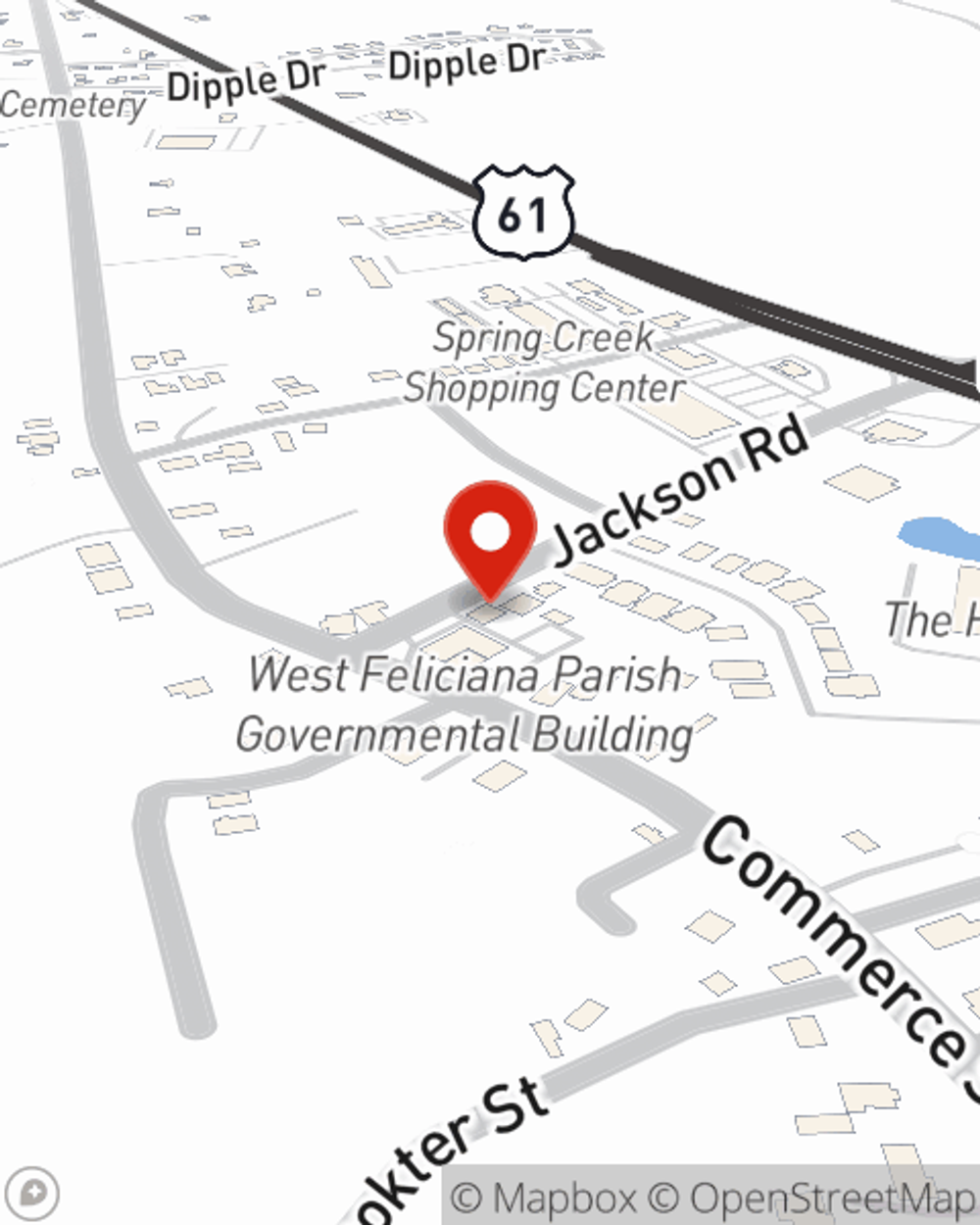

- St Francisville

- W. Feliciana Parish

- Ethel

- Norwood

- Jackson

- E. Feliciana Parish

- Clinton

- New Roads

- Pointe Coupee Parish

- Zachary

- E Baton Rouge Parish

- Central

- State of Mississippi

- Woodville

- Wilkinson County

- Ventress

- Livonia

- Wilson

- Slaughter

- Baker

- Centreville

- Port Allen

- Brusly

- Liberty

Home Is Where Your Heart Is

One of the most important precautions you can take for your favorite people is to make sure your home is insured through State Farm. This way you can kick back knowing that your home is taken care of.

If walls could talk, St Francisville, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Agent Gwen Sellers, At Your Service

Gwen Sellers can walk you through the whole coverage process, step by step. You can have a straightforward experience to get a protection plan for everything that’s meaningful to you. We’re talking about more than just protection for your linens, clothing and home gadgets. Protect your family keepsakes—like souvenirs and collectibles. Protect your hobbies and interests—like videogame systems and sound equipment. And Agent Gwen Sellers can share more information about State Farm’s great savings and coverage options. There are savings if you choose a higher deductible or have home security devices, and there are plenty of policy inclusions, such as liability insurance to protect you from covered claims and legal suits.

It's always the right move to protect your home and valuables with State Farm. Then, you won't have to worry about the unforeseen blizzard damage to your property. Contact Gwen Sellers today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Gwen at (225) 635-3997 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Closing documents to keep after purchasing a house

Closing documents to keep after purchasing a house

A guide to the closing documents to keep after you buy your house — and what you can consider getting rid of.

Gwen Sellers

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Closing documents to keep after purchasing a house

Closing documents to keep after purchasing a house

A guide to the closing documents to keep after you buy your house — and what you can consider getting rid of.